If my BC Property Assessment goes up, does my property tax go up?

Relationship between Property tax and BC assessment values

Vincent Chan is a Director and partner at Meryl.REALTOR. His background includes Business Development | Strategic Marketing for real estate and law firms. Formerly he was a Director of Development & Marketing at Electronic Arts. His passions include architecture, interior design, writing, photography and design. You can reach him via email: [email protected]

If my BC property assessment decreases, will my property tax decrease?

A common misconception is that if your property assessed value decreases, then your property tax decreases respectively. Unfortunately, this is not quite true. This article will explain how property tax is calculated and how you can estimate whether your property taxes will increase or decrease.

The British Columbia Assessment Authority (BCA) publishes property assessment values across the province on January 1 of the year. However, property taxes are not determined at the BC Provincial level but at the city and municipal levels based on their operating budgets.

TOTAL PROPERTY TAX BUDGET = TOTAL PROPERTY TAX COLLECTED over all property classes

(1) ![]()

Property Tax Rates for each class and Property tax calculations

Once the total tax required by budget is determined, Cities publish property tax rates (also known as mill rates) across each class of property. Within each class, the tax share is distributed fairly using the BC Assessments multiplied by the property rate for that class. Please note that property rates across classes are not the same (example: industrial land class rate is different from residential class rate).

PROPERTY TAX RATES (or MILL RATES) for each property class

(2) ![]()

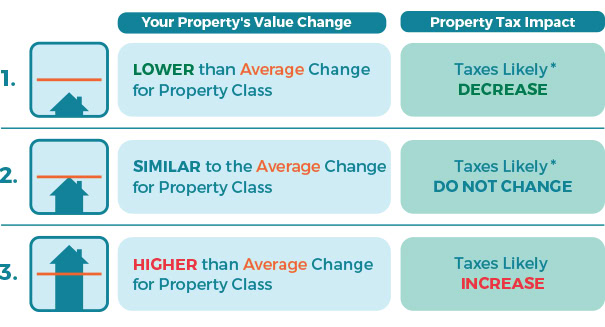

How do I estimate whether my property taxes will increase or decrease?

Whether your property taxes will increase or decrease is based on 2 primary factors: 1) How much the city budget increases/decreases 2) How your property assessment compares to average property in the same class. For example, for 2020 the city of vancouver has passed the budget to increase property taxes by 7%. This baseline 7% increase is the primary factor that most residential homes will see an increase around 7% in 2020.

However, your property tax may be more than or less than this baseline 7% depending on your property assessment. See examples below…

Example A: Your Vancouver property is currently assessed at $432,000 based upon a valuation date of July 1 last year. Your previous assessed value was $540,000. Your property decreased -20% in value, while the average decrease for residential properties was -10%. Since your property decrease was LOWER THAN the average for your property class, you will likely see LOWER THAN 7% increase in your property taxes.

Example B: Your Vancouver property is currently assessed at $583,900, based on a valuation date of July 1 last year. Your previous assessed value was $630,000. Your property decreased -7% in value, while the average decrease for your property class is -10%.

Since your property decrease was NOT AS LOW the average, you will likely see MORE THAN 7% increase in your property taxes.

Why do the examples say *taxes likely* change?

The estimate makes the assumption that the share of tax across classes remain the same. This is not always the case. For example, in Vancouver 2020 budget, there will be a shift in tax share between the small business class to the residential property class.

You can check out the BC Assessment summary video on how to estimate your tax increases. NOTE: The video has 2 assumptions: that the city budget remains the same AND that there is no shift in tax share between the classes. In contrast, my examples above consider both of these changes in 2020.

BC Assessment 2020 RESOURCES

The table below summarizes percentage % change in assessment values from 2018 to 2019 for Greater Vancouver and Fraser Valley. We can see that in Greater Vancouver there are mostly drops but that there are % increases in specific areas of the Fraser Valley like Whistler, as well as for commercial and industrial property types.

| Property Type | Greater Vancouver % changes (Assessments 2019 vs 2018 as of July 1, 2019) | Fraser Valley % changes (Assessments 2019 vs 2018 as of July 1, 2019) |

| Residential Single Detached Homes | -15% to 0% | -15% to +5% |

| Residential Strata Units | -15% to 0% | -15% to 0% |

| Commercial | -15% to +20% | -5% to +25% |

| Industrial | -5% to +20% | 0% to +25% |

On a more local level, Vancouver residential home values dropped on average between -8.8% to -10.20%. In Coquitlam the drop in housing value assessment ranged from -9.3% to -10.7%.

Property classes in BC

| PROPERTY CLASS | DESCRIPTION |

| Class 1, Residential | single-family residences, multi-family residences, duplexes, apartments, condominiums, nursing homes, seasonal dwellings, manufactured homes, some vacant land, farm buildings and daycare facilities. |

| Class 2, Utilities | structures and land used for railway transportation, pipelines, electrical generation or transmission utilities, or telecommunications transmitters. This property class does not include gathering pipelines, offices or sales outlets. |

| Class 3, Supportive Housing | this property class only includes eligible supportive housing property that has been designated by Cabinet. Eligible supportive housing property is funded by the provincial government or a health authority for the provision of housing that includes on-site support services for persons who were previously homeless, at risk of homelessness, and who are affected by mental illness or who are recovering from drug or alcohol addictions or have other barriers to housing. For more information, visit Classifying Supportive Housing Property. |

| Class 4, Major Industry | land and improvements (buildings and structures) of prescribed types of industrial plants, including lumber and pulp mills, mines, smelters, large manufacturers of specified products, ship building and loading terminals for sea-going ships. |

| Class 5, Light Industry | property used or held for extracting, processing, manufacturing or transporting products, including ancillary storage. Scrap metal yards, wineries and boat-building operations fall within this category. Exceptions include properties used for the production or storage of food and non-alcoholic beverages and retail sales outlets, which fall into Class 6. For more information, visit Light Industrial vs. Business and Other Property Classifications. |

| Class 6, Business Other | property used for offices, retail, warehousing, hotels and motels all fall within this category. This class includes properties that do not fall into other classes. |

| Class 7, Managed Forest Land | privately-owned, forest land managed in accordance with the Private Managed Forest Land Act or the Forest and Range Practices Act. Property owners in this class have an obligation to provide good resource management practices, such as reforestation, care of young trees, protection from fire and disease and sound harvesting methods. |

| Class 8, Recreational Property, Non-profit Organization | Recreational Land - land used solely as an outdoor recreational facility for specific activities such as golf, skiing, tennis, public swimming pools, waterslides, amusement parks, marinas and hang gliding. Improvements on the land (such as a clubhouse) fall into Class 6. - land in a rural area that is part of parcel used for overnight commercial accommodation that exists predominantly to facilitate specific outdoor recreational activities such as hunting, fishing and kayaking. Improvements on the land most likely fall within Class 6 (e.g. a hotel). Non-Profit Organization Land and Improvements - property used or set aside for at least 150 days per year as a place of public worship or as a meeting hall by a non-profit, fraternal organization. The 150 days cannot include activities with paid admission or the sale/consumption of alcohol. - additionally, the 150 days needs to be in the year ending on June 30 of the calendar year preceding the calendar year for which the assessment roll is being prepared. |

| Class 9, Farm | to qualify as farm for assessment purposes, the land must produce a prescribed amount of qualifying primary agricultural products for sale, such as crops or livestock. Farm buildings come within Class 1. For more information on farm land, visit Classifying Farm Land |

LEARN ABOUT BC PROPERTY ASSESSMENTS VS MARKET VALUE

Frequently Asked Questions

According to BC Assessment, information about a property is gathered during construction and renovation. After that appraisers review market data every year on July 1st. The physical condition and zoning of the property is reviewed by October 31st. Finally assessment information begins to be sent out December 31.

Jan 31st is the deadline for homeowners to request a review or appeal their home assessment value.

Vancouver: Feb 4 Advanced Tax Notices

Vancouver: July 3 Property Taxes Due, Homeowner Grants submission.

No. Each municipality uses the BC Assessment to determine how to distribute its property tax burden. For example, the city of Vancouver elected to raise its property taxes by 7% in 2020 and this increase will be shared amongst homeowners in % relation in that class. To determine how much your property tax will change is based on both the budgeted increase and how your assessment compares with the average in your property class.

How do I keep updated on my home's market value?

While the British Columbia Assessment (BCA) provides a good baseline for estimation, there are many other factors that go into a home market evaluation. You can keep up to date in a variety of ways:

Get SOLD Prices and New Listings

- View recent sold prices

- Average asking prices

- How fast are homes selling?

- Is it a buyers or sellers market?